Some Ideas on Clark Wealth Partners You Need To Know

The 5-Minute Rule for Clark Wealth Partners

Table of Contents7 Simple Techniques For Clark Wealth Partners5 Simple Techniques For Clark Wealth PartnersThe Greatest Guide To Clark Wealth PartnersAll about Clark Wealth PartnersGetting The Clark Wealth Partners To WorkThe Of Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is DiscussingThe Ultimate Guide To Clark Wealth Partners

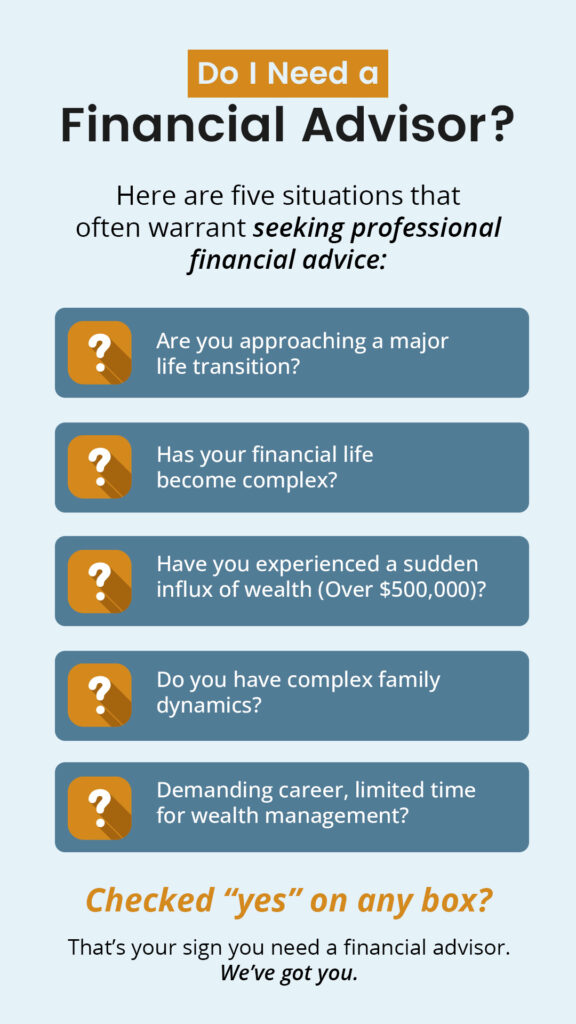

Usual reasons to consider an economic expert are: If your financial situation has become a lot more complex, or you lack self-confidence in your money-managing skills. Conserving or navigating significant life events like marriage, separation, children, inheritance, or work change that might considerably affect your economic circumstance. Browsing the transition from conserving for retired life to preserving riches throughout retirement and exactly how to develop a solid retirement revenue plan.New innovation has actually led to more comprehensive automated economic tools, like robo-advisors. It depends on you to check out and identify the right fit - https://clrkwlthprtnr.carrd.co/. Inevitably, a good monetary expert ought to be as conscious of your financial investments as they are with their own, staying clear of too much fees, saving cash on tax obligations, and being as transparent as possible regarding your gains and losses

4 Easy Facts About Clark Wealth Partners Described

Making a payment on item referrals does not always suggest your fee-based expert antagonizes your ideal passions. Yet they might be extra likely to advise product or services on which they earn a commission, which may or might not remain in your benefit. A fiduciary is lawfully bound to put their customer's interests initially.

They may follow a freely checked "viability" requirement if they're not registered fiduciaries. This basic allows them to make referrals for investments and services as long as they match their client's goals, threat tolerance, and financial scenario. This can equate to recommendations that will certainly also earn them cash. On the other hand, fiduciary experts are lawfully obligated to act in their customer's best passion instead than their very own.

Not known Facts About Clark Wealth Partners

ExperienceTessa reported on all things investing deep-diving right into complex financial topics, shedding light on lesser-known financial investment avenues, and revealing means readers can function the system to their advantage. As a personal finance professional in her 20s, Tessa is really aware of the effects time and uncertainty carry your financial investment decisions.

It was a targeted advertisement, and it functioned. Review a lot more Check out less.

How Clark Wealth Partners can Save You Time, Stress, and Money.

There's no solitary course to coming to be one, with some people starting in financial or insurance, while others start in bookkeeping. 1Most monetary organizers begin with a bachelor's level in financing, economics, audit, company, or a relevant topic. A four-year degree provides a strong foundation for occupations in investments, budgeting, and customer service.

Clark Wealth Partners Can Be Fun For Everyone

Typical examples include the FINRA Series 7 and Collection 65 examinations for safety and securities, or a state-issued insurance license for offering life see this or medical insurance. While credentials may not be legally needed for all intending roles, companies and customers typically see them as a benchmark of professionalism and trust. We take a look at optional qualifications in the following area.

A lot of monetary coordinators have 1-3 years of experience and experience with monetary products, conformity requirements, and straight customer interaction. A solid instructional history is necessary, however experience demonstrates the capacity to apply theory in real-world setups. Some programs incorporate both, permitting you to complete coursework while gaining monitored hours through teaching fellowships and practicums.

A Biased View of Clark Wealth Partners

Lots of get in the area after working in banking, accountancy, or insurance coverage, and the transition requires persistence, networking, and often sophisticated credentials. Early years can bring long hours, stress to develop a customer base, and the demand to consistently confirm your know-how. Still, the career uses solid long-lasting capacity. Financial coordinators appreciate the possibility to function very closely with clients, overview vital life decisions, and often attain adaptability in routines or self-employment.

They spent less time on the client-facing side of the sector. Almost all economic managers hold a bachelor's level, and several have an MBA or similar graduate level.

The Greatest Guide To Clark Wealth Partners

Optional qualifications, such as the CFP, generally need additional coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Stats, personal monetary advisors gain a median annual yearly income of $102,140, with top income earners gaining over $239,000.

In various other provinces, there are regulations that require them to meet certain demands to use the financial advisor or financial organizer titles (financial advisors Ofallon illinois). What sets some financial experts apart from others are education, training, experience and qualifications. There are several designations for financial experts. For financial organizers, there are 3 common designations: Licensed, Personal and Registered Financial Organizer.

10 Easy Facts About Clark Wealth Partners Described

Where to locate a monetary expert will certainly depend on the type of suggestions you need. These organizations have team that may aid you comprehend and buy specific types of investments.